Estafa and bouncing checks law have similarities but they also have their own distinctions. Course Title IS MISC.

Special Laws Rfbt Batas Pambansa Blg 22 Bouncing Check Law An Act Penalizing The Making Or Studocu

Issuing a check Eto yung nilalagay mo yung name ng payee and amount and the signature of the payor.

Anti bouncing check law pdf. Students who viewed this also studied. This is a preview of the Anti-Bouncing Check Law. 22 or the bouncing checks law.

Checks without sufficient funds. Pages 2 This preview shows page 1 - 2 out of 2 pages. It is also unlawful for any official or employee.

Bank Secrecy Law RA 1405 This is an act prohibiting disclosure of or. Any person who makes or draws and issues any check to apply on account or for value knowing at the time of issue that he does not have sufficient funds in or credit with the drawee bank for the payment of such check in full upon its presentment which check is. When check is issued in payment of an obligation.

Full PDF Package Download Full PDF Package. Commonwealth Act No142 Regulating the Use of Aliases - No person shall use any name different from. Bouncing Checks Law.

An individual can be held legally liable for the crime of estafa for issuing bouncing checks. Guarantee check to guarantee the performance of principal obligation. Anti bouncing check law pdf A lot of people are confused by the similarities and differences of estafa and bouncing checks law.

Checks without sufficient funds. Even if check is issued in payment of a pre-existing obligation violation of BP22 may be committed. SPECIAL LAWS BP 22 - Anti-Bouncing Checks Law - The gravamen of BP 22 is the issuance of a check.

Anti-bouncing Check Law Sec. A short summary of this paper. Any person who makes or draws and issues any check to apply on account or for value knowing at the time of issue that he does not have sufficient funds in or credit with the drawee bank for the payment of such check in full upon its presentment which check is.

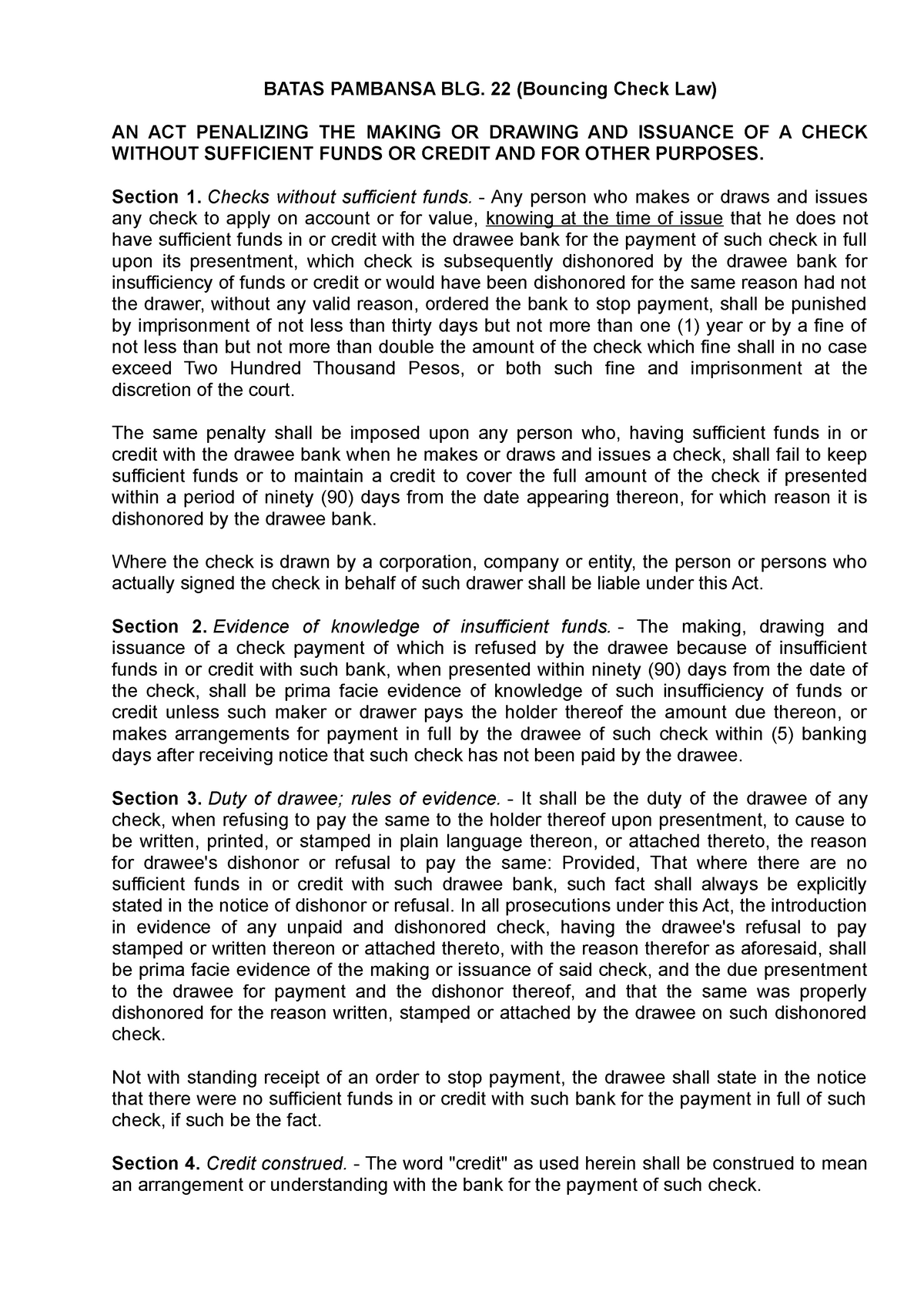

The issuance of the check is done before or at the same time that the obligation is incurred. Bouncing Checks Law BP 22 A person can be charged for violation of BP 22 when he commits the following acts. 22 AN ACT PENALIZING THE MAKING OR DRAWING AND ISSUANCE OF A CHECK WITHOUT SUFFICIENT FUNDS OR CREDIT AND FOR OTHER PURPOSES.

And nearly twenty-four years since the Supreme Court in the landmark case of Lozano v. In the Philippines there are two laws which criminalize and punish the issuance of bouncing checks. Batas Pambansa Bilang BP 22 It is a law that governs the criminal liability arising from the issuance of bounced checks.

Sunday March 6 2022. Foreign check is a check drawn against a foreign bank. - Any person who makes or draws and issues any check to apply on account or for value knowing at the time of issue.

What the law punishes is the issuance of a bouncing check and not the purpose for which the check was issued nor the terms and conditions of its issuance. 22 and Article 315 Sec. Without Sufficient Funds or Credit was passed into law.

41 Anti Bouncing Checks Lawpdf - 41 Anti Bouncing Checks Lawpdf - School Far Eastern University. Persida AcostaDear PAOI received a demand letter from my creditor to pay the amount corresponding to the postdated checks I issued which were dishonored because of. Bouncing Checks Law Second Revised Edition 1995 Thirty-one years have passed since Batas Pambansa Big.

Checks a written request or order by a depositor called the drawer to a bank called the. Bouncing checks are checks which are returned by the bank because their issuers do not have sufficient funds on deposit. Share this link with a friend.

Making or drawing and issuing any check to apply on account or for value knowing at the time of issue that he does not have sufficient funds in or credit with the drawee bank for the payment of such check in full upon its. Bounced checks constitute crime of estafa. Section 1 of the Bouncing Checks Law penalizes two distinct acts.

So in order to have a clearer and simpler understanding of both concepts I have listed down in a tabular form their. BOUNCING CHECKS LAW BATAS PAMBANSA BLG. Institution including investments in bonds.

Political subdivisions and instrumentalities. Drawee to pay on encashment a person called a payee a certain sum of money. THE ANTI-BOUNCING CHECK LAW.

Issued by the Philippine government and its. So issuance of check before or after the obligation has been incurred may lead. It is essential to know both concepts as they will help you determine which one to file when a crime is committed.

Provided That where there. This presumption is overcome only if the issuer pays or makes arrangements for payment of the full amount of the check within five banking days after receiving a notice of its dishonor. Anti-bouncing Check Law Sec.

Another term for it is rubber check. Checks not covered by BP 22 Managers check Cashiers check it is good as cash. This law was a well-meaning attempt to curb the proliferation of bouncing checks which was perceived to be damaging to commercial transaction where the check as a negotiable instrument was a convenient tool of business and persona1 dealings.

22 otherwise known as An Act Penalizing The Making Or Drawing And Issuance Of A Check Without SUfficient Funds Or Credit was passed into law. In order to afford protection to business and the public in general and prevent the. The law presumes that the issuer knew of the insufficiency of his funds if the check is dishonored within 90 days from the date of the check.

Estafa may be committed by the issuance of a worthless check just like in bouncing checks law. BP 22-ANTI-BOUNCING CHECKS LAW BOUNCING CHECK-BUM CHECKBAD CHECK ESTAFA BY POSTDATING A CHECK BP 22 Drawer and indorsers are liable Only drawer is liable Mere issuance of a worthless check is a felony Mere issuance of a bad check is not a crime Concomitant obligation only Concomitant and pre-existing debt Mala in se-good faith is a defense Malum. BP 22 Bouncing Checks Law.

Revisiting Batas Pambansa Blg. 2 d of the Revised Penal Code. It contains a comparison of BP Blg.

Bouncing check check that has no. This term originated from the fact that a check is bounced back from the bank. - It shall be the duty of the drawee of any check when refusing to pay the same to the holder thereof upon presentment to cause to be written printed or stamped in plain language thereon or attached thereto the reason for drawees dishonor or refusal to pay the same.

22 AN ACT PENALIZING THE MAKING OR DRAWING AND ISSUANCE OF A CHECK WITHOUT SUFFICIENT FUNDS OR CREDIT AND FOR OTHER PURPOSES. 7 Full PDFs related to this paper. Inquiry into all types of deposits in any banking.

Checks without sufficient funds. The assignment is about Anti-Bouncing Check where the questions lead you to know the essential requisite liability and the difference between BP 22 and.

Bouncing Check Law Bp22 Pdf Fine Penalty Cheque

Komentar